Roundtable Discussion on the Report, ‘Financial Inclusion of Women during the Pandemic’ | 4th November 2022

with Aishwarya Narayan, Arisha Salman, Mitali Nikore, Mannat Sharma, Sharmishtha Nanda, Sonal Jaitly and Dr. Sumita Kale

The pandemic witnessed women being disproportionately affected in terms of loss of economic opportunities, including the loss of jobs and the loss of income, which deepened their financial exclusion. To mitigate the gendered impact of the pandemic in India, the Central Government (‘CG’) introduced one of the largest cash transfers programmes under the flagship Pradhan Mantri Garib Kalyan Yojana (‘PMGKY’) initiative for women holding Pradhan Mantri Jan Dhan Yojana (‘PMJDY’) accounts. Under the PMGKY initiative, during April 2020 – June 2020, the CG transferred INR 1500 to women-held PMJDY accounts (INR 500 each for three months).

The Vidhi Centre for Legal Policy (Vidhi) undertook a study titled “Financial Inclusion of Women During the Pandemic | The Role of Jan Dhan Accounts and Cash Transfers” (‘Study’) to assess the effect of cash transfers on the financial behaviour of women as well as the overall accessibility and use of financial services by women during the pandemic. For conducting the Study, we surveyed 3 sets of respondents; 560 women customers, 17 business correspondents (‘BCs’) and 23 financial institutions (‘FIs’), consisting primarily of public and private sector banks.

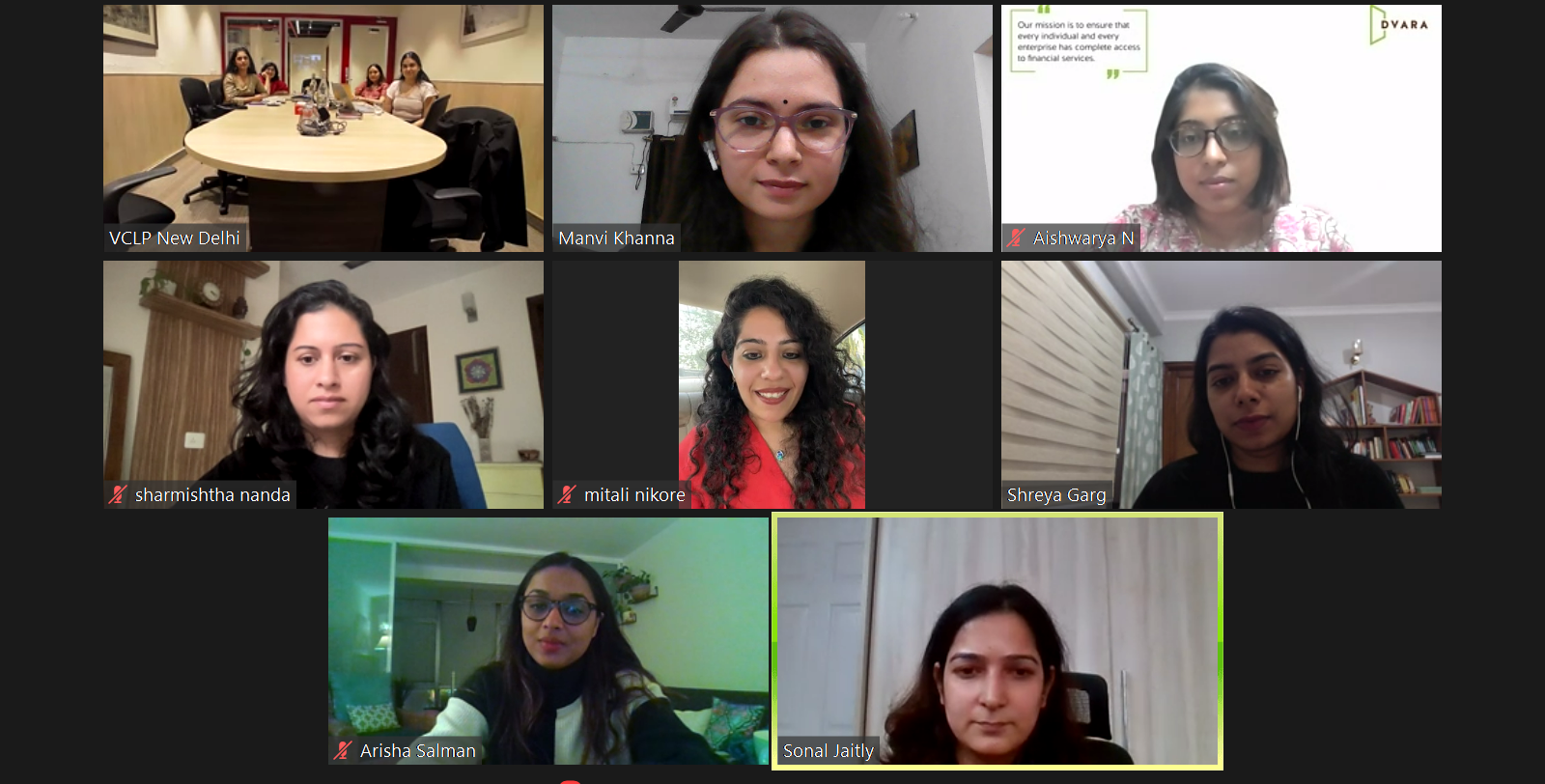

Vidhi organised a roundtable discussion on 4th November 2022 with experts from the financial inclusion space on some of the themes explored in the Study. Through this discussion, Vidhi sought to inform the findings of its Study better and gain insights from experts on the challenges of the cash transfer system in India, specifically for women, and the necessary measures needed to further the financial inclusion of women during events like a pandemic, and beyond.

The roundtable discussion saw the participation of seven experts in the field of financial inclusion: Aishwarya Narayan, Research Associate, Social Protection Initiative at Dvara Research; Arisha Salman, Financial Sector Analyst, CGAP; Mitali Nikore, Founder, Nikore Associates along with Mannat Sharma, Research Manager, Nikore Associates; Sharmishtha Nanda, Independent Consultant; Sonal Jaitly, Senior Manager and Lead, Gender Equality and Social Inclusion Practice, Microsave Consulting and Dr. Sumita Kale, Honorary Advisor, Indicus Foundation. It was moderated by Swarna Sengupta, Research Fellow (Fintech) and Manvi Khanna, Research Fellow (Law, Finance and Development) and also saw the participation of Shreya Garg, Lead (Law, Finance and Development) and Shehnaz Ahmed, Lead (Fintech) from Vidhi.

Examining Key Issues | Cash Transfer Systems and Access to Banking Infrastructure during the Pandemic

A. Role of Cash Transfer System and its Effective Implementation

Findings from the Study:

- Less than half the women surveyed (23% of women respondents with PMJDY accounts) received the cash transfers for all three months;

- More than 90% of women who received the cash transfer in any or all of the three months, withdrew the cash for regular use.

- Usage of PMJDY accounts was limited during the lockdown as indicated by 45% of the women respondents with PMJDY accounts.

- The majority of women respondents indicated that they did not use their PMJDY accounts to deposit any income (68%) or utilize overdraft facilities (85%) during the pandemic.

Key Takeaways from the Discussion:

In light of the Vidhi findings, the following issues were discussed with the participants:

- Given that our Study found that not all women beneficiaries received cash transfers for all three months, the first issue focussed on the inefficiencies of or the challenges faced by the cash transfer initiative and the possible measures to mitigate the same.

- There was a consensus amongst the participants that more than the cash transfer itself, it was the implementation of the scheme and lack of awareness regarding it that may have created issues for women beneficiaries.

- Other challenges identified by the participants included: the non-processing of the cash transfers in the dormant accounts or to the accounts that may have not had their KYC updated or Aadhar linked, as well as the lack of a physical monitoring mechanism to ensure whether the cash transfer has been received by the beneficiary.

- The participants also highlighted the need to have physical touchpoints and offline architecture for the disbursal of cash transfers to ensure that failure of digital back-end processes as mentioned above does not lead to the exclusion of women beneficiaries.

- Given that our Study found that the existing literature on the issue has been divided, the second issue focussed on the role of cash transfers in advancing the financial inclusion of women.

- Many participants indicated that cash transfers, if targeted and directed at women, are indeed helpful to low-income women customers in an emergency such as the pandemic.

- Specifically, PMGKY coupled with other Direct Benefit Transfer (‘DBT’) schemes such as Pradhan Mantri Garib Kalyan Anna Yojana (‘PMGKAY’) played an important role in helping the lower-income households during the pandemic.

- Important caveats to these observations were that the exclusion error along with the backend infrastructure issues attached to the DBT, in this case, PMGKY should have been minimized to reach more beneficiaries.

- An important key takeaway to improve the design of the cash transfer in itself has been that while designing digital policymakers need to make sure that the design accounts for those at the margins and considers their needs, in this case the low-income women beneficiaries, to ensure that scheme is a success.

- The participants also highlighted that the success of a DBT scheme for women will also depend on the nature of the awareness initiatives that have been undertaken to inform them such as text message intimation in their local language and whether they have access to convenient touchpoints through which they can obtain the DBT.

- For the third issue, the participants discussed other policy interventions that could have been undertaken either by financial sector intermediaries or by financial sector regulators to address the gendered impact of the pandemic, beyond the PMGKY.

- Considerable investment is required in women’s financial literacy, and skill training along with the creation of the right insurance products for them that account for their needs. Moreover, specifically in terms of cash transfers, it is important for them to be unconditional and take into account factors such as (i) the value of the cash transfer amount might be different in each state taking into account the economic disparities, (ii) many states would have their own- state run schemes for a similar group of beneficiaries and (iii) there would be an urban-rural variation in the value of the cash transfer amount.

B. Accessibility to banking infrastructure during the lockdown and the role of FIs and BCs

Findings from the Study:

- Bank branches were preferred sites for the withdrawal of money in comparison to accessing ATMs, using the services of BCs, or net banking.

- The main challenges identified by women respondents in accessing banking infrastructure during the lockdown included long travel and cost to avail banking infrastructure, absence of cash in ATMs, BCs not operating, and bank branches not working.

- Majority of the women respondents with PMJDY Accounts had access to a phone, however, there was very limited use of digital financial services by women with 39% of them indicating they did not undertake any financial services using their phones.

- Targeted communication/awareness programmes on behalf of FIs during the pandemic were largely missing. The majority of women respondents who indicated awareness campaigns to have taken place (85%) found them to be useful.

- Women preferred female BCs as suggested by more than 50% of the FIs, due to lesser hesitancy in approaching them, comfort in communication as well as better response received from them to their concerns.

Key Takeaways from the Discussion:

In light of the Vidhi findings, the following issues were discussed with the participants:

- Our Study found that bank branches were the preferred modes for withdrawing cash during the pandemic by women customers. Respondents who could not access such banking infrastructure cited distance and travel costs as primary hurdles. Our analysis attributed this primarily to a preference for physical touchpoints, and personalised services. Therefore, participants discussed the steps necessary to ensure such access and build trust in other forms of banking as well.

- While the participants agreed that the current power dynamics to interact with members of a FI hinder a woman from accessing them, a cadre of women (such as female BCs) with which these customers may resonate or with which they might be able to communicate would be very relevant in increasing their agency.

- Moreover, the level of trust that is derived from accessing bank branches in comparison to other forms may be attributed to history and experience which is lacking in other channels. Thus, the onus should be put on the financial service providers to explain each mode of banking infrastructure better along with the grievance redressal mechanism attached to it.

- ‘One Gram Panchayat One Bank Sakhi’ initiated by the Ministry of Rural Development was mentioned as one such commendable measure undertaken to address many of the issues women customers face in accessing banking infrastructure.

- As per our Study, though the majority of women respondents had access to phones, it was used to undertake basic financial services such as checking account balances. Therefore, participants discussed the relevance of technology in streamlining cash transfers or providing financial services in general, given the extant gender gaps in having access to phones as well as the internet.

- The key takeaway on this issue has been that financial literacy and awareness can be created for financial services using technology specifically for women users that have been using phones or have started using phones.

- Having celebrities or influencers already seen on television explain the product in a less formal setting and a fun manner i.e., through “edutainment” may be one good way of increasing digital comfort amongst women customers, who otherwise may tend to skip watching a purely educational video.

- Our Study found that women customers who were part of outreach programmes, on financial literacy found them to be highly useful. The participants briefly discussed important components of outreach programmes regarding government schemes, financial products and services as well as digital banking which are essential from a gender perspective.

Some of the critical components of such outreach programmes identified by the participants were:

- an ongoing and continuous effort to reach the maximum number of women customers rather than on an event-to-event basis,

- in-person interaction by the members of FIs, civil society organisations, Self Help Group members with women customers,

- better targeting by the FIs as well as leveraging the extant BC network along with enhancing their role and;

- interactive audio-visual technology-based solutions for the oral segment of women customers.