The Law Needs to Account for Her

Reforms to make finance inclusive

Setting the Context

For decades, India’s economic and financial growth story has suffered due to a critical missing piece: women. Women across all segments, be it entrepreneurs or retail customers, face multiple barriers in accessing finance in an equitable manner. These are spread across legal, socio-cultural and infrastructural barriers such as restricted mobility, lack of traditional collateral, lower ownership of mobile phones and access to internet, lower financial literacy levels, to name a few. Research suggests that the business case for a financial institution to serve women customers is strong and adding a gender lens to existing laws and financial products is crucial. For instance, the unmet credit gap for women-owned enterprises is 70.37% which translates to a financing gap of INR 1.37 Lakh Crore and presents a huge market opportunity for financial institutions

Vidhi’s working paper titled ‘The Law needs to Account for Her: Reforms to make Finance inclusive’ focuses firstly on select legal and policy reforms which directly impact financial inclusion of women customers; and secondly on certain gaps in the financial products and services offered to women customers and recommendations to make these more suitable for women.

Key issues and recommendations

A. The first part of the paper identifies and discusses three issues and corresponding recommendations:

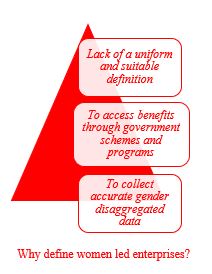

Defining women led enterprises

The Ministry of Micro Small and Medium Enterprises, women specific loan schemes of banks, Public Sector Undertaking policies (for meeting the mandate of 3% procurement from women owned enterprises under the Public Procurement Policy 2018), government credit schemes for women, state specific industrial policies, all define women owned enterprises differently on the parameters of ownership, management and control. The lack of a uniform and suitable definition of women owned enterprises in the Indian legal framework poses problems in extending benefits of government schemes offering credit products, and collecting accurate gender disaggregated data to understand the needs of the segment. The paper recommends that the Micro, Small and Medium Enterprises Development Act, 2006 (MSMED Act) be amended to add a criterion classifying MSMEs based on whether they are owned/led by women. Following this amendment, a new circular may be issued or the circular issued by the Ministry of MSME on 26th June 2020 may be amended to include a definition of women led enterprises. The use cases of such a definition range from earmarking of credit to women led enterprises by banks; better targeting of women centric schemes, initiatives and products; collection of gender disaggregated data; and a consolidated digital platform for such enterprises – all of which contribute towards creating an enabling ecosystem for women entrepreneurs. This chapter of the paper presents only the beginning of a myriad possibilities which a definition in law may bring about for women led enterprises in the country.

Engaging female business correspondents (BCs)

BCs further the agenda of financial inclusion in all parts of the country by providing basic banking facilities to the unserved customers at their doorstep. Their role is crucial, especially for women customers as they solve the mobility, time and hesitancy constraints a woman may face in accessing financial products and services. Research suggests that women prefer using female BCs for most of their banking transactions due to the level of comfort and trust they have with them. However, the representation of female BCs in the total BC network is less that ten percent. Onerous minimum qualification criteria, mobility and safety challenges, lack of ability to invest in technical equipment and lack of life and health insurance coverage are few of the issues identified in our paper, impeding the enhanced representation of female BCs. We suggest that the Reserve Bank of India (RBI) issues a circular laying down broad principles for support measures to be extended to female BCs by banks and Business Correspondent Network Managers (BCNM). The measures most suitable to female BCs may be in the nature of technical equipment support, mobility support and other financial measures such as insurance, in addition to efforts to transform female BCs from mere cash-in cash-out (CICO) agents to relationship managers.

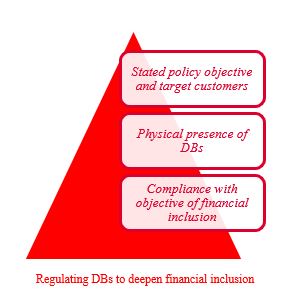

Pivoting Digital Banks (DBs) towards financial inclusion of women

In November 2021, NITI Aayog released a discussion paper proposing the licensing and regulatory regime for DBs, setting the tone for a framework to be released by the RBI. Recognising the immense potential DBs have in serving the specific needs of a specific customer segment, the paper lays down recommendations for RBI to regulate DBs with an objective to deepen financial inclusion in its legal framework as and when it is formulated, along with a gender lens. Our recommendations include: (a) stating explicitly the policy objective of financial inclusion for DBs along with the target segments of DBs to include women customers and MSMEs (specifically women led MSMEs); (b) not prohibiting physical presence of digital banks, as in developing countries, physical networks are critical in enabling customers to convert cash into e-money and vice versa and hence, for transitioning from a cash economy to a digital one; and (c) components of a business plan with financial inclusion targets to be included in the framework (also requiring banks to specify their target segment) in addition to compliance with the objective of financial inclusion as a pre-condition for transition from the regulatory sandbox to a full bank.

B. Second part of the paper takes a deep dive into the financial products and services offered to women customers from a gender lens by financial service providers (FSPs).

An in-depth analysis of savings and credit products offered by five public sector banks (PSBs), five private sector banks (PvSBs), eleven small finance banks (SFBs), ten non-banking finance company micro-finance institutions (NBFC-MFIs) and thirteen fintech companies indicate that:

- Very few credit products for women enterprises are offered by banks. Only two PSBs and one PvSB offered customised credit products to women enterprises, and no such products were provided by SFBs;

- Limited to negligible concessions are offered, in the form of waiver of processing fees and documentation charges, for credit products offered to women enterprises and retail women customers, thus increasing the banking cost for them. However, such waivers are available to some extent for Self-Help Groups;

- Run of the mill non-financial services (cashbacks, locker discounts, fire and theft insurance etc.) offered by banks along with savings accounts and are not gender-specific. Only one SFB out of all the banks offered consultation with gynaecologists, mental health experts and complimentary health check-ups along with its savings account;

- Doorstep banking and relationship managers are quite relevant for women customers, however such services were offered only by some banks and that too only for high income segment customers;

- There has been no effort towards simplifying paper work or complex financial and legal language keeping women in mind;

- Fintechs catering specifically to women provide only investment advisory services and a platform to women to learn financial concepts such as money management, but no specific savings or credit products are offered.

This part of the paper supplements the gaps in the financial products and services offered to women with lessons from international examples that have stood out and have been successful in serving the needs of women customers. Our recommendations for FSPs focus on gender responsive features that may work better for women such as providing relevant non-financial services, including legal and accounting assistance to women enterprises, simpler user interface, innovative collaterals as well as targeting products by segmentation of women.

Way Forward

In continuation of our work, we organised a closed-door virtual roundtable discussion with leading domain experts on 25 April 2022 on some of the themes covered in our working paper. While the first session focused on women enterprises and female business correspondents, and the critical challenges faced by them, the second revolved around the missing gender lens in the existing financial products offered to women customers and the scope of digital financial services to further financial inclusion.

Through this working paper, we have ideated certain reforms which may bring us a step closer in achieving financial inclusion of women in India. A brief snapshot of our recommendations, pointing out legal reforms that may be undertaken by the government and RBI, as well as certain steps that may be taken by FSPs in their approach towards offering financial products and services to their women customers is captured in the table below:

| S. No | Action Points | Implementing entity |

| 1. | Define women led enterprises through an amendment in the MSMED Act. | Ministry of MSME |

| 2. | Introduce random verification by the General Manager, District Industries Centre of a set number of women led enterprises on an annual basis under MSMED Act. | Ministry of MSME |

| 3. | Create a separate category of women led enterprises in the following: (i) RBI’s Priority Sector Lending Directions 2020, under the micro enterprises sub-target; (ii) RBI’s 2000 Directions comprising of the 14 point action plan for women for PSBs, for earmarking a certain percentage to such enterprises within the mandated 5% net bank credit to be extended to women. | RBI |

| 4. | Add a separate category of women led enterprises as a data point in the Basic Statistical Returns and Monitoring Progress of Financial Inclusion Returns, which are the main source of collecting data from Scheduled Commercial Banks. | RBI |

| 5. | Develop a digital platform for women led enterprises for capturing their financial information, connecting to vendors and providing financial and non-financial services | Ministry of MSME and RBI |

| 6. | Issue a circular laying down broad principles for support measures (equipment, mobility related, financial) to be extended to female BCs as well as steps to transform them from CICO agents to relationship managers, by banks and BCNMs. | RBI |

| 7. | The proposed framework for digital banks to include a financial inclusion lens, specifically for women customers in the provisions relating to objective, target segment, business plan, and transition pre-conditions for such banks | RBI |

| 8. | The proposed framework for DBs to not prohibit physical networks of such banks and use of agent networks | RBI |

| 9. | Add a gender lens to the products and services offered to women customers in the form of various non-financial services, simpler interface, innovative collateral and segmentation of women | FSPs |

| 10. | Include specific measures and targets for women in India’s National Strategy for Financial Inclusion 2019-2024. | RBI |