R&D and Innovation in Corporate India

Law Reform Proposals for Making India an R&D Powerhouse

The Context

The COVID-19 pandemic and the challenges posed by it made glaringly evident the importance of R&D and innovation for sustainable growth and development. While India Inc. played a very important role in developing and supporting responses to the crisis, most knowledge-based solutions came from countries whose businesses innovate more. In countries that are widely recognized as global R&D leaders, the private sector remains the pivotal contributor to R&D. When compared with global standards, India Inc.’s performance on R&D metrics is relatively poor. Even if this issue were to be evaluated outside the framework of the crisis, on the face of it, the track record of Corporate India on innovation and R&D does not appear to be in sync with India’s long-term economic aspirations. Vidhi’s report titled “R&D and Innovation in Corporate India: Law Reform Proposals for Making India an R&D Powerhouse” (Report) attempts to explore key reasons that contribute towards such underperformance and examine linkages between structural factors that could be negatively affecting the innovative efficacy of Indian enterprises. It also proposes legal reforms for overcoming such structural limitations.

While private limited companies (including start-ups) play a very important role in contributing to a nation’s R&D output, they are often cash-strapped and their ability to invest in R&D on a sustainable basis is limited by design. Having said that, recent research indicates that globally, private limited companies (especially those operating in the pharmaceutical sector) contribute immensely to the development of new products and technologies. Therefore, to get a complete picture of Corporate India’s contribution to R&D and innovation in India, it would be important to study trends in private limited companies as well. Nevertheless, the scope of this report is largely limited to the R&D and innovation performance of publicly listed companies (including government owned companies/public sector units) given their more readily measurable and arguably greater impact potential. The phrases ‘Corporate India’ or ‘India Inc.’ as used in the Report in relation to Indian businesses should be construed accordingly.

Corporate R&D Expenditure Trends and Sectoral Trends

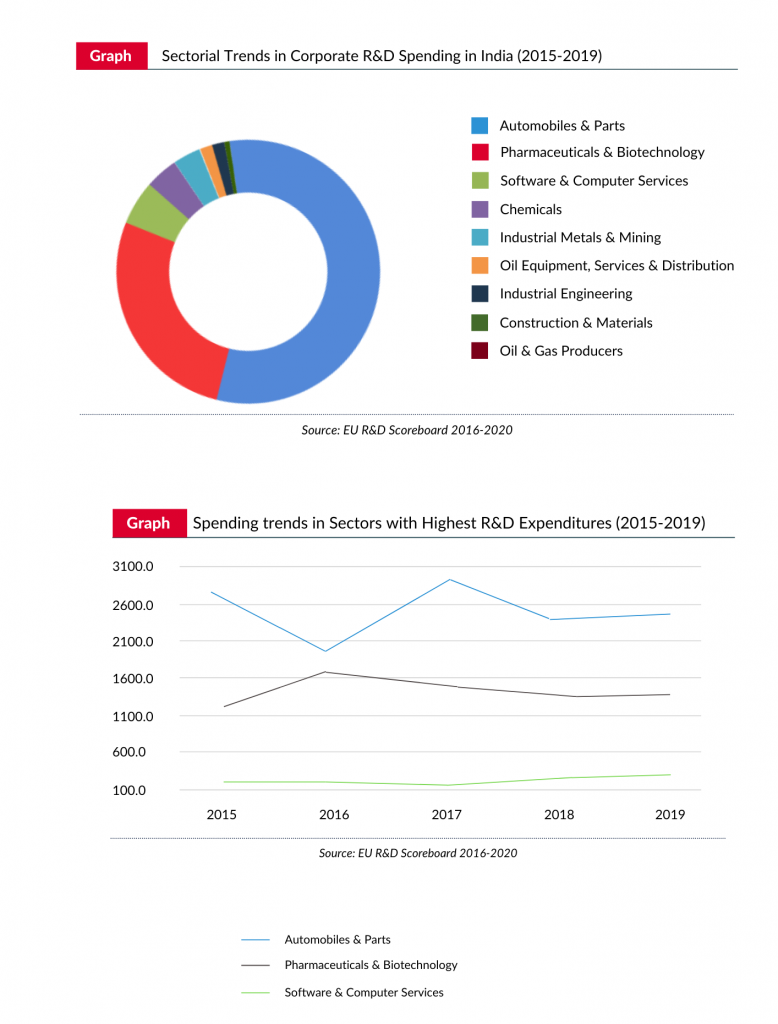

R&D performance can be estimated through certain ‘innovation indicators’ which are typically measures of ‘innovation efforts’ or ‘innovation outputs’ of an enterprise. Metrics like an enterprise’s expenditure on R&D or number of R&D personnel hired or patents filed can be used to measure its innovation efforts. For deriving trends relating to Corporate India’s R&D performance, we have relied on R&D expenditures of Indian enterprises as a metric. This data is recorded in the European Union Industrial R&D Investment Scoreboard (EU Scoreboard) published by the Joint Research Centre of the European Commission which captures R&D spending data of top 2500 global R&D spenders (as disclosed in their annual financial statements) and records R&D spending of several prominent Indian listed companies. We have examined data forming part of the 2016, 2017, 2018, 2019 and 2020 iterations of the EU Scoreboard (for the years 2015, 2016, 2017, 2018 and 2019 respectively) for our study.

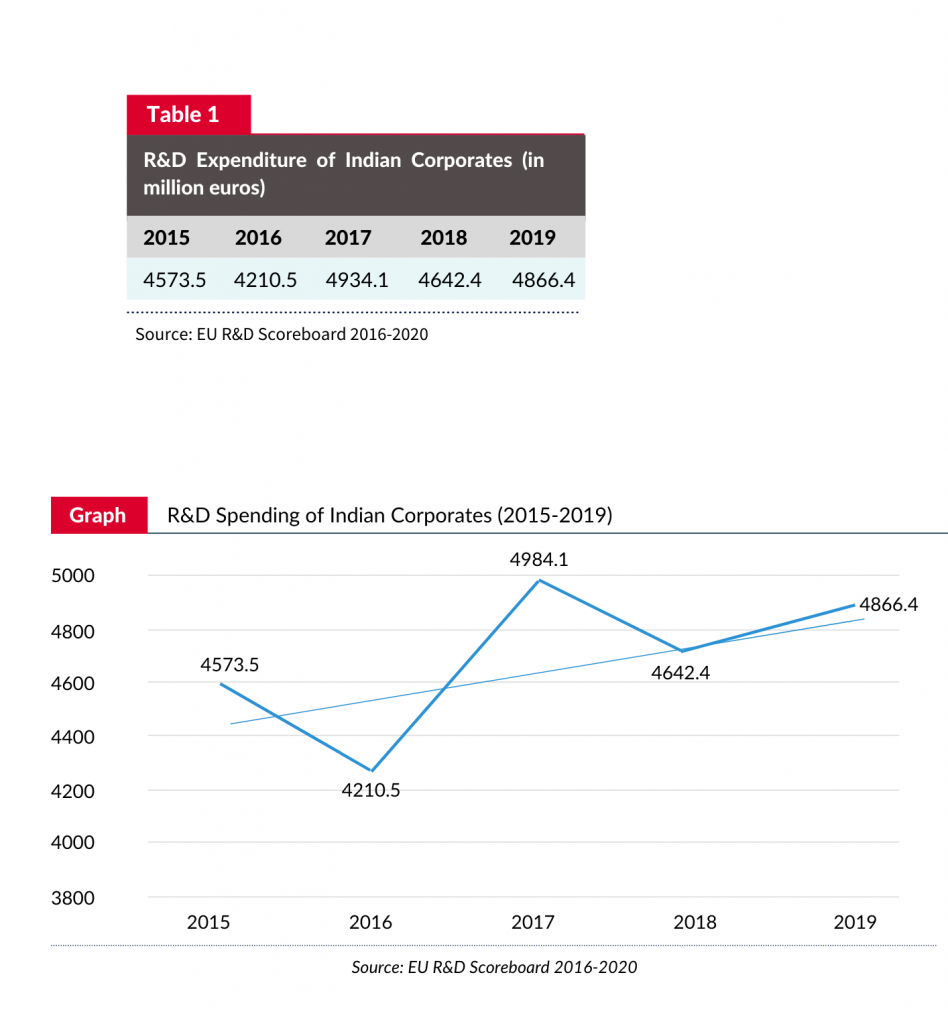

At the outset, Indian listed companies surveyed in the EU Scoreboard cumulatively spent 4866.4 million Euros (or 424.4 billion Indian rupees) on R&D activities in 2019. Table 1 details the spending of surveyed Indian enterprises over the five-year period under review (2015-19). During this period, there was an overall increasing trend in the R&D spending of Indian listed companies (in line with the global trend), but such increases were not consistent as reduced R&D outlays were reported in 2016 and 2018 (as compared to the previous year values). In 2017, the Indian corporate R&D expenditure was at its highest during the five- year period.

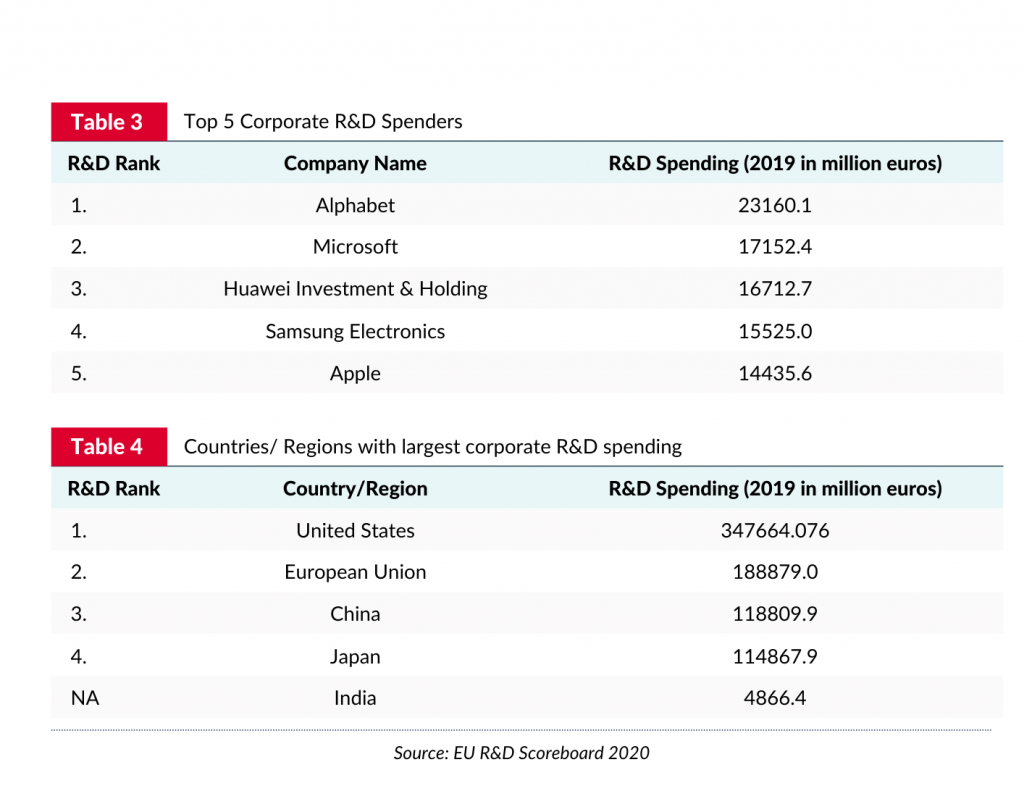

Some international trends are also noteworthy: in 2019, the top five companies with the largest R&D outlays (Alphabet, Microsoft, Huawei Investment & Holding, Samsung Electronics and Apple) spent 17 times more on R&D than the combined spending of all surveyed Indian listed companies. Businesses situated in the United States (US) spent 71 times more on R&D as compared to Indian listed companies in 2019. Similarly, EU businesses spent 38 times more, and Chinese and Japanese businesses spent nearly 24 times more than Indian entities. In 2019, the contribution of Indian listed companies to the global corporate spending on R&D was merely 0.5% percent, and only one Indian entity (Tata Motors Limited) figures in the top 100 global spenders on R&D in 2019. This underscores the pressing need of policy interventions to bring Corporate India’s R&D spending in line with global levels.

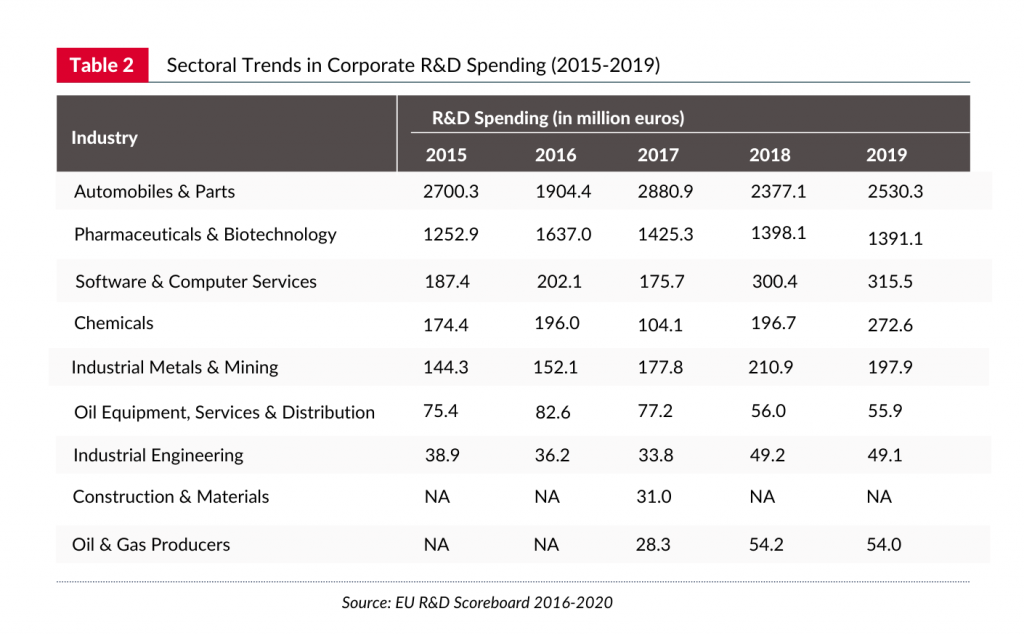

From a sectoral perspective, Indian listed companies operating in the following sectors spent significant sums on R&D in a five-year period between 2015-2019: (i) automobiles and parts, (ii) pharmaceuticals & biotechnology, (iii) software and computer services, (iv) chemicals, (v) industrial metals & mining, (vi) oil equipment, services & distribution, (vii) industrial engineering construction and (viii) materials oil & gas producers. Table 2 sets out the sectoral R&D spending data.

Trends relating to R&D investment in FY 2020-21

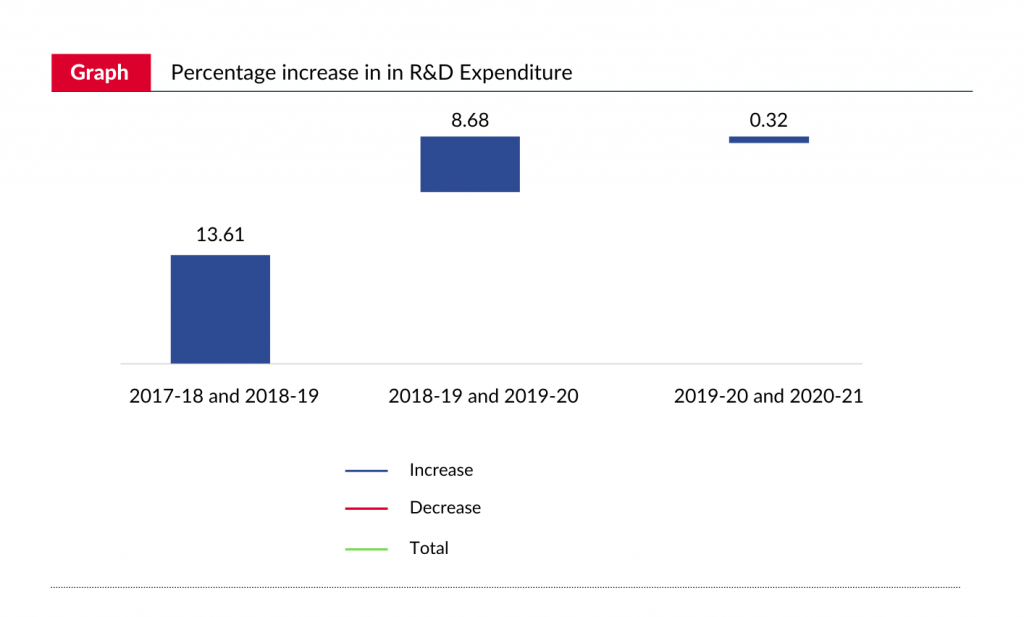

The years 2020 and 2021 have been extraordinarily challenging given the catastrophic impact of the COVID-19 pandemic. Besides causing a massive loss of human life and suffering at an unprecedented scale, the pandemic also bootstrapped a severe economic downturn. This period also witnessed a surge of research activity throughout the world directed towards finding curative and preventive remedies to treat the COVID-19 disease and enabling the drastic shift to remote work models. In our study, we have also attempted to derive trends relating to R&D spending of Indian listed companies during the year 2020-21. For this, we record the R&D spending as reported by 22 Indian listed companies in their Annual Reports for 2020-21, which were reported to be the largest R&D spenders in India in 2020 (as per the EU Scoreboard), and then compared it with their R&D outlays in the past 3 years (2017-18, 2018-19 and 2019-20) as noted in their Annual Reports for previous years. The key findings of this study are set out below.

- The R&D spending of the surveyed listed companies showed an increasing trend in FY 2020-21.

- However, the rate at which corporate R&D spending increased in FY 2020-21 was significantly lower as compared to previous years (change rate for FY-2020-21: 0.32%, as compared to 13.61% and 8.68% in FY 2017-18 and FY 2018-19 respectively).

- Over a four-year horizon (between FY 2017-18 to FY 2020-21), it seems that corporate R&D expenditure has been increasing, but at a declining rate. However, a more comprehensive study may be required to confirm this trend.

- The rate of increase of corporate R&D spending declined in all sectors in FY 2020-21. In some sectors (automobiles and industrial metals and mining) there was a substantial contraction in corporate R&D spending in FY 2020-21 as compared to earlier years. Corporate R&D expenditure increased in the following sectors – pharma, chemicals and software and computers, yet the percentage increases were smaller as compared to earlier years.

Legal and Policy Landscape: Review of Central and State Level R&D Policies, Incentives and Programs

In India, the framework at the central level provides various incentives to businesses undertaking R&D activities. Various statutes like the Income Tax Act, 1961 and the Customs Act, 1962 contain provisions granting fiscal incentives to such enterprises. Key fiscal benefits that can be availed inter alia include: (i) tax deductions for capital and revenue expenditure incurred for R&D activities and contributions made to Indian companies or notified institutions for R&D purposes; (ii) reduced tax rate of 10% on royalty income earned from patents developed and registered in India; and (iii) customs duty exemptions on import of specified components for R&D activities.

Various programs and schemes operated by central government departments / bodies (like the Department of Science and Technology, Department of Scientific and Industrial Research, Department of Biotechnology, Ministry of Environment, Forest and Climate Change, Council of Scientific and Industrial Research, Technology Development Board etc.) aim to provide funding to businesses undertaking R&D activities. Some other central schemes instead of focusing on funding, target improving the overall research and infrastructural facilities (including for e.g., through development of common R&D facilities to be used by industry clusters) and augmenting the professional skills of the country’s R&D manpower.

Moreover, various states have also launched programs under their industrial and start-up policies for providing funding and institutional support to enterprises engaged in R&D activities. Some state governments in India have also notified (or are in the process of adopting) dedicated state level R&D policies recognising the significance of having well-developed industrial R&D and innovation capabilities in the state. Such policies have typically targeted specific sectors and aim to provide concessions like soft loans, subsidies, and exemptions etc., to corporate entities undertaking R&D activities. Measures to develop long-term innovation capacity building in targeted sectors have also been envisaged in these policies. Details regarding policy initiatives and funding programs at the central and state levels are provided in the Annexure to the Report.

Overall, R&D policies in many states are short term oriented and largely sector specific, whereas some states have not formulated policies to promote corporate sector R&D. States may therefore consider adopting comprehensive, dedicated and streamlined frameworks to promote corporate R&D and modernize their institutional machinery to curb existing bottlenecks. This could be achieved through suitable state level statutory interventions. Also, for greater harmonization of the R&D policy landscape across the country, the central government may also consider issuing guidelines to state governments setting out relevant best practices and key principles in this regard.

R&D and Corporate Governance

Given that innovative capacity and harnessing of innovation in companies is not just shaped by market forces but also by internal governance structures, it becomes important to examine the relationship between corporate governance (CG) factors and their impact on promoting as well as hindering innovation. Typically, R&D activities are characterized as high risk and yielding cross-period income which often results in them being viewed as posing serious agency problems centred around controlling managers’ opportunistic behaviour and information asymmetry which ultimately influences corporate decision-making. Linked to such agency problems is the fact that underinvestment in R&D can arguably be attributed to the existence of shareholder ‘myopia’, or ‘short-sightedness’ (also referred to as short- termism) which may take many forms: shareholders who make up an increasing percentage of company ownership are ‘short-term’ oriented and are therefore disinclined towards R&D investments relative to other long-term investments. The fact that appropriate corporate governance mechanisms can address these concerns makes it even more important to understand the relationship between relevant CG variables and R&D investment.

Broadly, literature review identifies three key corporate governance factors, namely ownership structures, boards of directors and incentive mechanisms that impact innovation. However, it is difficult to draw generalized conclusions regarding whether particular CG factors impact R&D investments positively or otherwise, and literature review suggests that these assessments can usually be made within the framework of a specific economic and legal and regulatory context. Having looked at the regulatory framework which govern these factors in the Indian context, it can be said that while India’s corporate governance framework has undergone a process of comprehensive evolution and modernization over recent years, there is still scope for improvement, especially in terms of meeting global standards and best practices in practice.

Lastly, it is important to note that globally, corporate governance standards have increasingly become convergent around a shareholder-centred model of accountability.In this regard, academic literature and empirical studies on the impact of this model on innovation suggests that these globally accepted standards require a moderated form of standardization whereby these standards may be adjusted to reflect the need for promoting corporate innovation.Essentially, such standardization entails re-imagining boards, shareholders, senior-management and other stakeholders differently and developing a new basis for requisite adjustment of corporate governance standards. In other words, adjusting provisions on board structures, composition, responsibilities and accountability are critical to ensuring that boards better serve the purposes of company innovation effectively.

Key Recommendations and Way Forward

Our key recommendations for improving the corporate R&D investment landscape in India are as follows:

- R&D Committee: For a specified class of listed entities, the Securities and Exchange Board of India (SEBI) may consider making the constitution of a qualified and independent R&D committee at the board level mandatory. The primary purpose of the committee could be to assist the board of directors in reviewing and assessing the company’s R&D programs, overseeing the company’s strategy and investment in R&D programs and to perform such other functions which may be necessary for carrying out these functions. This might help companies in inculcating a more disciplined and structured approach to their R&D activities.

- Chief Innovation Officer: For a specified class of listed entities, SEBI may consider making the appointment of an executive-level leader responsible for advancing the innovation agenda of companies, namely, a chief innovation officer (CInO) mandatory as this will ensure the incorporation of a formalized system of innovation in companies and ensure ownership and accountability at the level of the senior management. The primary responsibilities of CInOs may include formulation and execution of innovation strategies, capacity building and developing and managing partnerships for innovation.

- Enhanced R&D Disclosure Requirements: For a specified class of listed entities, SEBI may consider prescribing mandatory enhanced R&D related disclosure requirements as part of the SEBI (Listing Obligations and Disclosure Requirements) Regulations. Presently, there do not appear to be detailed requirements that mandate disclosures of R&D related information. Needless to say, such disclosure requirements should be structured in a manner that promote a ‘race to the top’ among R&D spenders without undermining the confidentiality of their commercial and proprietary secrets.

- Integrated Innovation Funding Platform for Central and State Level R&D Initiatives with a Separate Statutory Framework: The decentralized and fragmented manner in which funding schemes for R&D are managed at the central and state levels calls for a single window ‘Integrated Innovation Funding Platform’ (IIFP) in respect of R&D funding efforts of the government. We recommend that a separate statutory scheme should be formulated for creating a nodal authority for managing IIFP and addressing the aforementioned issues under a uniform statutory framework. This approach may also help the government in better monitoring of R&D projects funded with public money (whether directly funded or through tax-breaks) and also make the beneficiaries more accountable.

- Devising targeted frameworks to address key bottlenecks: Targeted policy interventions may be required to address bottlenecks in three key areas: (i) university-industry collaborations; (ii) R&D in strategically significant sectors (such as defence); and (iii) R&D initiatives at the level of state governments.

The purpose of the Report is to initiate a conversation around these issues to develop an enabling framework for making India an R&D powerhouse.