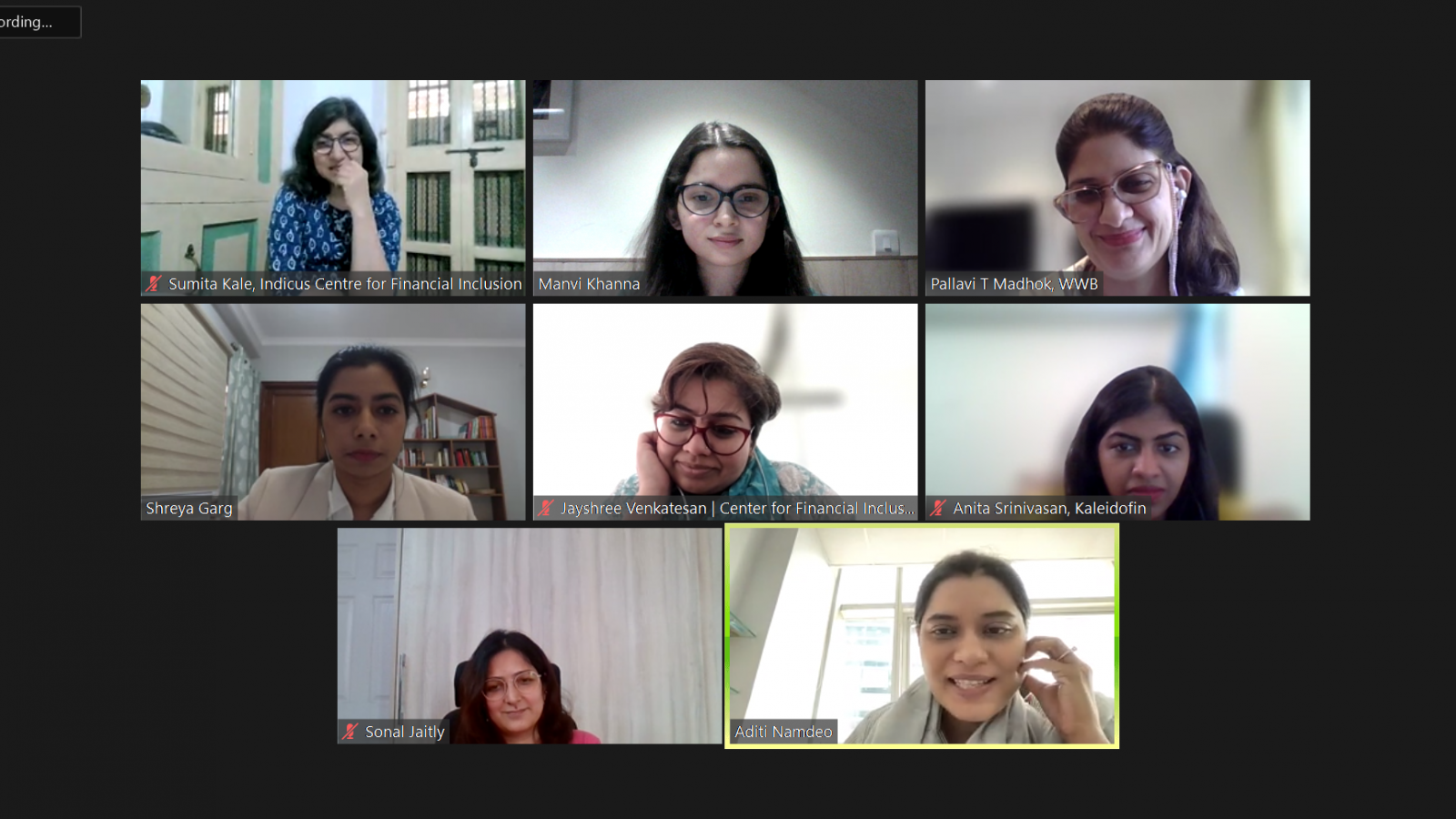

Vidhi’s Round Table Discussion on the Working Paper “The Law needs to account for Her” | 25th April 2022

with Aditi Namdeo, Anita Srinivasan, Jayshree Venkatesan, Pallavi Tewari Madhok, Sonal Jaitly and Dr. Sumita Kale.

The Law, Finance and Development team at the Vidhi Centre for Legal Policy, New Delhi (Vidhi) organized a virtual roundtable discussion on 25th April 2022 based on the themes present in its first independent report (in the form of a working paper) titled: “The Law needs to account for Her: Reforms to make finance inclusive”. The objective of the roundtable discussion was to inform the findings of the working paper prior to its release.

The roundtable was moderated by Shreya Garg, Senior Resident Fellow and Team Lead at Vidhi, and saw participation of six speakers: Aditi Namdeo, Chief Partnerships Officer, Reserve Bank Innovation Hub; Anita Srinivasan, Senior Product Manager, Kaleidofin; Jayshree Venkatesan, Director, Responsible Finance and Consumer Protection, Center for Financial Inclusion, Accion; Pallavi Tewari Madhok, Director of Advisory Services, India, Women’s World Banking; Sonal Jaitly, Senior Manager and Lead, Gender Equality and Social Inclusion Practice, Microsave Consulting; and Dr. Sumita Kale, Honorary Advisor, Indicus Foundation.

The roundtable started with a presentation on the working paper by Shreya Garg and Manvi Khanna from Vidhi, where three legal reforms relating to women enterprises, female business correspondents (BCs) and digital banks were discussed. For more details, please refer to Part A of our working paper here. We also discussed our research on the features of financial products and services offered to women customers by ten public and private banks, eleven small finance banks, ten NBFC-microfinance institutions and thirteen fintech companies. For our key findings and action points for financial service providers, please refer to Part B of the working paper.

The presentation was followed by two discussion sessions, the first focusing on women enterprises (Session I) and the second focusing on financial products and services offered to women customers (Session II). Session I sought to gain insights from each participant on critical challenges faced by women enterprises in India based on their experiences and possible interventions to address them. There was consensus amongst the discussants that for women in general, and women enterprises, targeting of schemes was inefficient and gender disaggregated data was not reliable. Some of the other challenges and possible areas of reforms suggested by the speakers related to adding a gender lens to the Code of Bank’s Commitment to MSMEs, simplifying the registration process for GST for women enterprises, improving the implementation of central policies at the branch level, the need for a national survey for collection of gender disaggregated data and the need for effective communication to address the lack of awareness of various schemes for women enterprises. The second issue that was discussed was regarding measures that the regulator may take to bolster the engagement of female BCs. The most important takeaway was that having a central BC registry is a must, and there should be a quota of 30-50% for women BCs for being hired by banks.

Session II comprised of a discussion on the existing biases that women customers come across in using financial products and Vidhi presented some examples of the same through its research. The key takeaways from this session to make financial products suitable for women were that there has to be an understanding that women have different needs which should be accounted for while designing products, and there is a very strong case for a high touch model in the distribution of financial products for women. The last issue which was briefly discussed related to the challenges that digitization of financial services and products pose to women customers in India. The importance of phygital experience for women was emphasized, and challenges such as mis-selling of products, lack of digital comfort of women with technology and mobile phones, and privacy of data were discussed.