Reforming the Governance of Co-operative Banks: A Study of State and District Central Co-operative Banks in 10 States

A consultative assessment and identification of issues pertaining to the governance framework of state and district central co-operative banks.

Summary: The Report undertakes a study of the governance framework of state and district central co-operative banks and helps identify gaps in the existing legal framework for governance of such co-operative banks.

Access to timely agricultural credit is crucial for the rural economy. Despite the emergence of new forms of banks, co-operative banks, by leveraging on their geographical and demographic outreach, play a critical role for the development of the rural economy, particularly in credit delivery. Therefore, the financial health and governance of such banks complemented by a robust regulatory framework is crucial for strengthening the role of such banks in the rural economy and to further financial inclusion objectives of the Government.

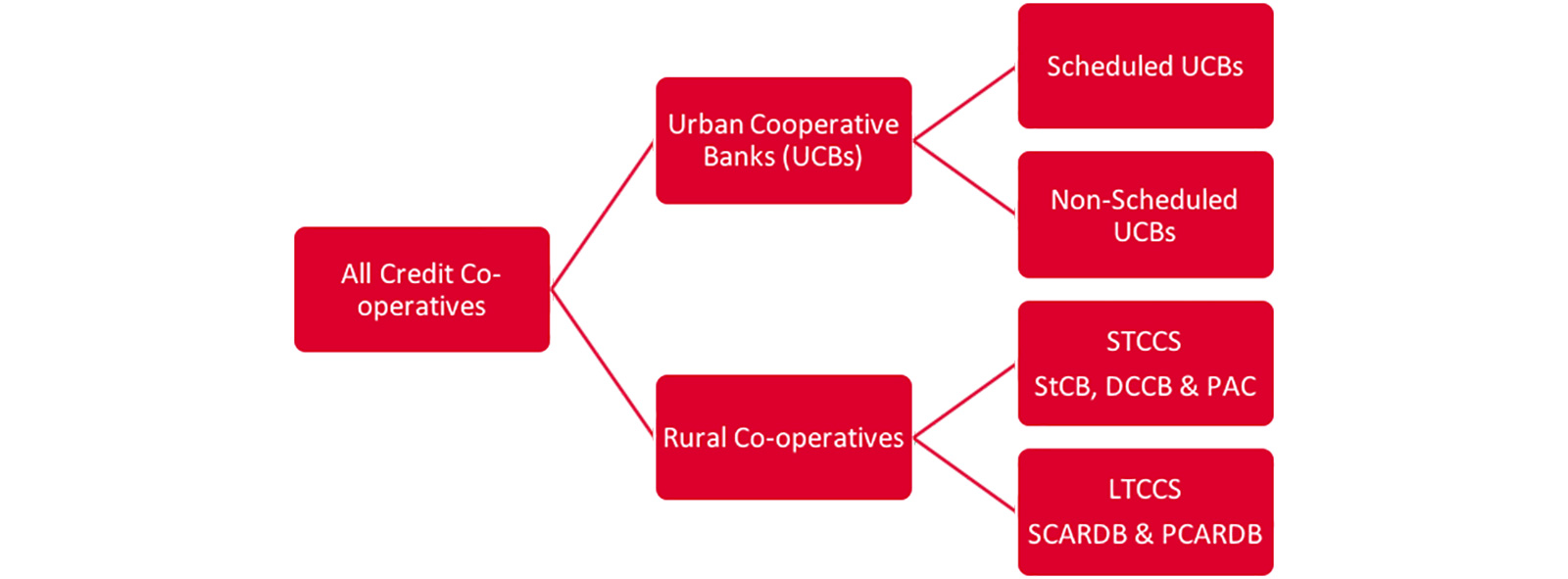

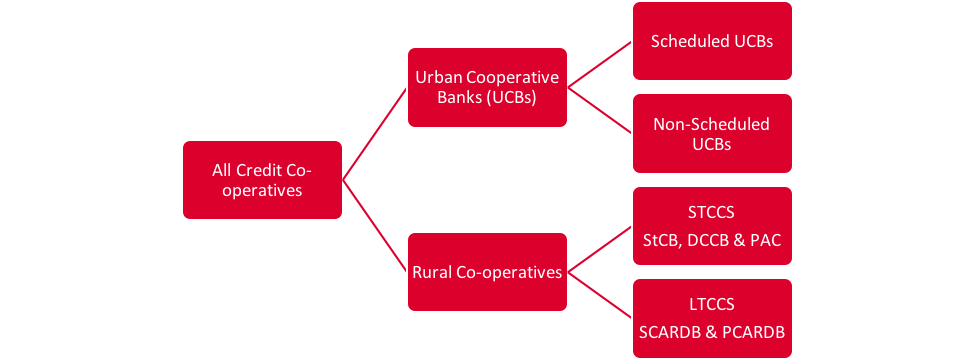

Co-operative credit structure in India

Broadly, the co-operative credit structure (CCS) in India consists of urban co-operatives and rural co-operatives. The rural CCS can be further divided into two groups –

(a) the short term CCS (STCCS); and

(b) the long-term CCS (LTCCS).

Typically, STCCS consists of a three-tier structure, with the state co-operative bank (StCB) as the apex institution in each state, the district central co-operative banks (DCCBs) operating at the district level and primary agricultural credit societies (PACS) working at the base (or the village) level. The STCCS provides crop and other working capital loans mainly for short-term purposes to farmers. The LTCCS comprising of state co-operative agriculture and rural development banks (SCARDB) and affiliated primary co-operative agriculture and rural development banks (PCARDB) mostly provide medium and long-term loans for making investments in agriculture, rural industries, etc.

Objective

While several committees and commentators have discussed the issues plaguing the co-operative banking sector, regulatory attention and policy discussions tend to have focused more on urban co-operative banks (UCBs). The focus of this project is on StCBs and DCCBs since such banks have received lesser regulatory attention (in comparison to UCBs and the commercial banking sector in general) despite being more prone to mismanagement and failures for reasons discussed above. Towards this end, this report amongst other things:

• identifies and studies the reasons behind governance related concerns in StCBs and DCCBs;

• maps the powers of the Reserve Bank of India (RBI) to regulate governance and resolution related issues in banking companies and StCBs and DCCBs;

• maps laws governing co-operative societies (including StCBs and DCCBs) in 10 states with a view to assess the regulatory position of different states insofar as governance of these banks are concerned; and

• provides recommendations for a more structured regulation of co-operative banks in India.

Key issues challenging the StCBs and DCCBs in India

• Given co-operative banks (operating in a single state) is a state subject under the Constitution of India, such banks are subject to dual regulation of:

(i) state specific laws in so far as their operations as a co-operative society are concerned, and

(ii) provisions of the Banking Regulation Act, 1949 (BR Act), which regulates the banking activities of these banks.

• Due to this constitutional allocation, RBI cannot exercise full control over such co-operative banks. It does not have powers in the appointment, removal of the directors and Chief Executive Officer (CEO), supersession of the board, winding up of such co-operative banks, etc. This is in contrast with the regulation of commercial banks and to an extent UCBs that are subject to a far greater scrutiny of RBI.

• A fragmented regulatory approach where these banks are subject to separate state laws on crucial issues such as qualifications of board members, voting rights of members, role of RBI in supersession, winding up, etc. is also a case of concern.

• Several committees have expressed concerns regarding the corporate governance in co-operative banks. Issues pertaining to absence of professional directors, appointment of CEO without requisite qualifications, supersession of the board by the State government, State involvement in the governance of such banks, etc. merit consideration.

Case for reform

The dual regulation and a fragmented legal framework create concerns for regulatory arbitrage. There is a case for arguing that there should be level playing field insofar as regulatory treatment of entities performing banking functions are concerned, regardless of their legal structure. Although the primary purpose of this report is to underscore the problems of StCBs and DCCBs in India, it also makes the following preliminary recommendations regarding possible approaches for a more structured regulation of co-operative banks.

1. Short-term recommendations: Extend the provisions of the BR Act to multi-state co-operative banks. The incorporation, regulation and winding up of multi-state co-operative societies is currently dealt with by the Multi State Co-operative Societies Act, 2002 which was enacted by the Parliament pursuant to Entry 44 of List I. Given that the power to regulate such societies is within the legislative competence of the Parliament, the government should consider extending all the provisions of the BR Act as applicable to a banking company to multi-state co-operative banks.

2. Medium-term recommendations: These recommendations seek to provide the Central Government acting through the RBI and /or any other central authority with direct supervisory powers for regulation and resolution of StCBs and DCCBs. For this purpose, the Report highlights the following possible approaches:

• Amend the constitution to expressly empower the Central Government to regulate co-operative banks. One possible approach suggested by the report is to amend the Seventh Schedule of the Constitution to carve out the regulation and resolution of co-operative banks from the State List and add the same as a new entry to the Concurrent List. This will enable both central and state governments to legislate on co-operative banks. Pursuant to this amendment, the Central Government should enact a law for regulating co-operative banks. It should clearly set out the objective, scope and extent of the law. The proposed law may extend to specific co-operative banks which may be determined based on attributes such as size, nature and volume of transactions, interconnected with other financial institutions (if any), etc. Any other co-operative bank may be regulated by the state government, subject to such banks meeting minimum requirements set out in the central law.

• Resolution under Article 252: Under Article 252 of the Constitution, legislatures of two or more states may pass resolutions accepting the authority of the Parliament to pass a law on a subject with respect to which Parliament has no power to make laws for the state. Any law so passed by the Parliament will be applicable to the concerned state that passed an Article 252 resolution and any other state that by which it is adopted afterwards. Pursuant to such a resolution, the Parliament can enact a law for regulation and resolution of co-operative banks that will only be applicable to such states that passed and / or adopted such a resolution.

• Draft a model law: The Central Government may consider drafting a model law on co-operative banks which can then be adopted by the state government. A model law for co-operative banks will pave the way for focused regulatory attention on such banks. However, past experience indicates that states have typically not been forthcoming in implementing such model laws as there is no obligation on them to adopt such laws.