Modernising the Law for Payment Services in India | Preparing for the Future of Retail Payments

A safe and well-functioning payments ecosystem is critical to support economic activity. Technological innovations are transforming the financial system, and payments continue to remain the leading sector impacted by such innovations. While the initial impact was seen in the large-value payment systems, the recent years have witnessed efforts by policymakers and the industry to revolutionise the retail payments sector that enables households and businesses to make and receive payments. Such efforts recognise the growing adoption and role of digital payments, that has also been accentuated by the Covid-19 pandemic.

The Digital Payments Index launched by the Reserve Bank of India (“RBI”) shows a rapid adoption and deepening of digital payments across the country in recent years. While India continues to have a “strong bias for cash payments”, studies show that there is a growing propensity towards digital payments adoption. Given the value proposition of digital payments and the consumer shift towards such payments, it is important to reassess the key enablers for creating a conducive ecosystem for further uptake and sustained usage of digital payment by retail consumers. One such key enabler is a conducive legal and regulatory framework. In India, the Payment and Settlement Systems Act, 2007 (“PSS Act”) (i.e. the primary law for governing digital payments) was enacted more than a decade back when the digital payments market in India was at its nascent stage. The law was primarily enacted to regulate payment systems from a systemic perspective and to confer the RBI with necessary powers to regulate these systems. Therefore, the PSS Act does not take into account policy goals and legal provisions that are critical to support the growth of a retail payments sector. While the RBI has time and again sought to address the existing gaps in the primary law through directions issued from time to time, this may not be the optimal regulatory / policy response. Such an approach is also not in line with the international best practices where several countries have, along with policy interventions, undertaken efforts to modernise their payments law to adapt to the rapidly evolving industry.

Against this background, this Report argues that India needs to reassess the PSS Act taking into account the developments in the retail payments sector since its enactment and the future of digital payments in India. By deconstructing the digital payments value chain, tracing global best practices in payment system regulation and identifying the existing gaps in the PSS Act, this report argues for a modern retail payment services law in India that is built on the principles of proportionate regulation and balances regulatory flexibility with well-established statutory mandates that can promote competition, innovation and consumer protection

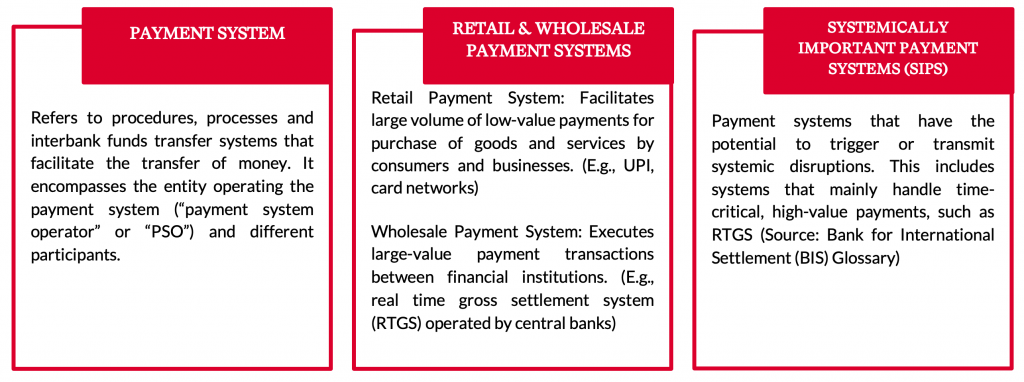

What is a payment system and the systemically important payment system (“SIPS”)?

Regulating Payment Systems | Global Best Practices

Case for Redesigning India’s Payment Systems

Since the enactment of the PSS Act, the payments landscape has undergone extensive changes due to the emergence of disruptive technologies leading to technology led payment solutions. Despite such developments, the PSS Act has not undergone any significant changes since its enactment almost a decade back except for certain amendments regarding the protection of consumer funds and finality of payment and settlement instructions. Existing gaps in the PSS Act is set out below.

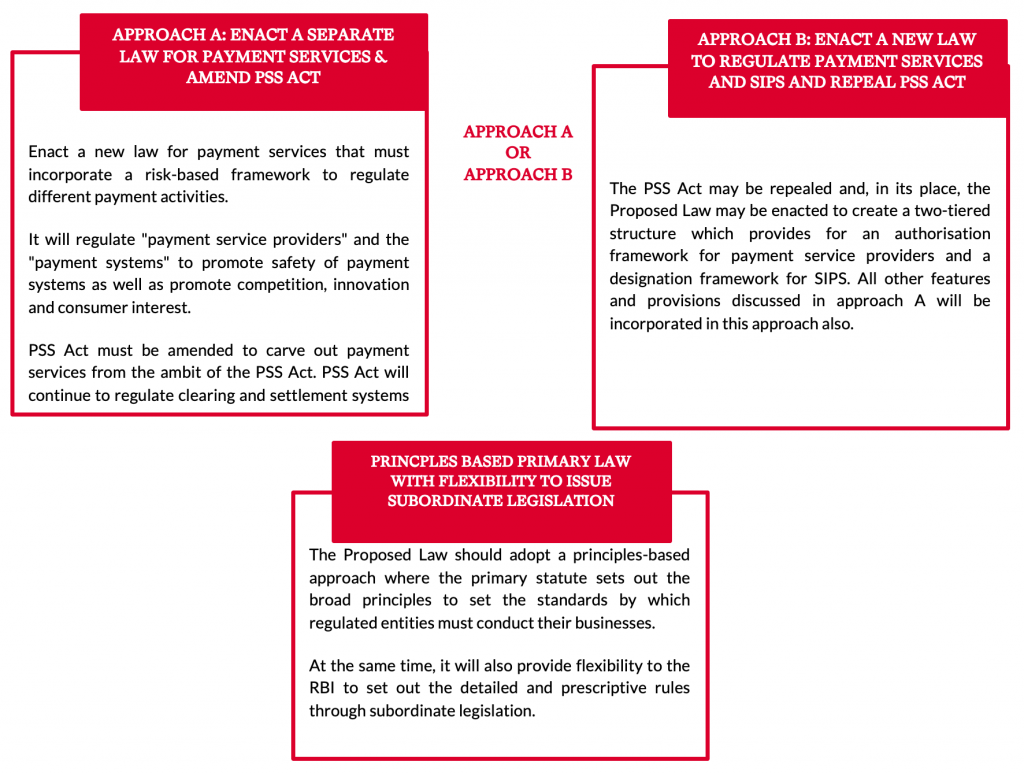

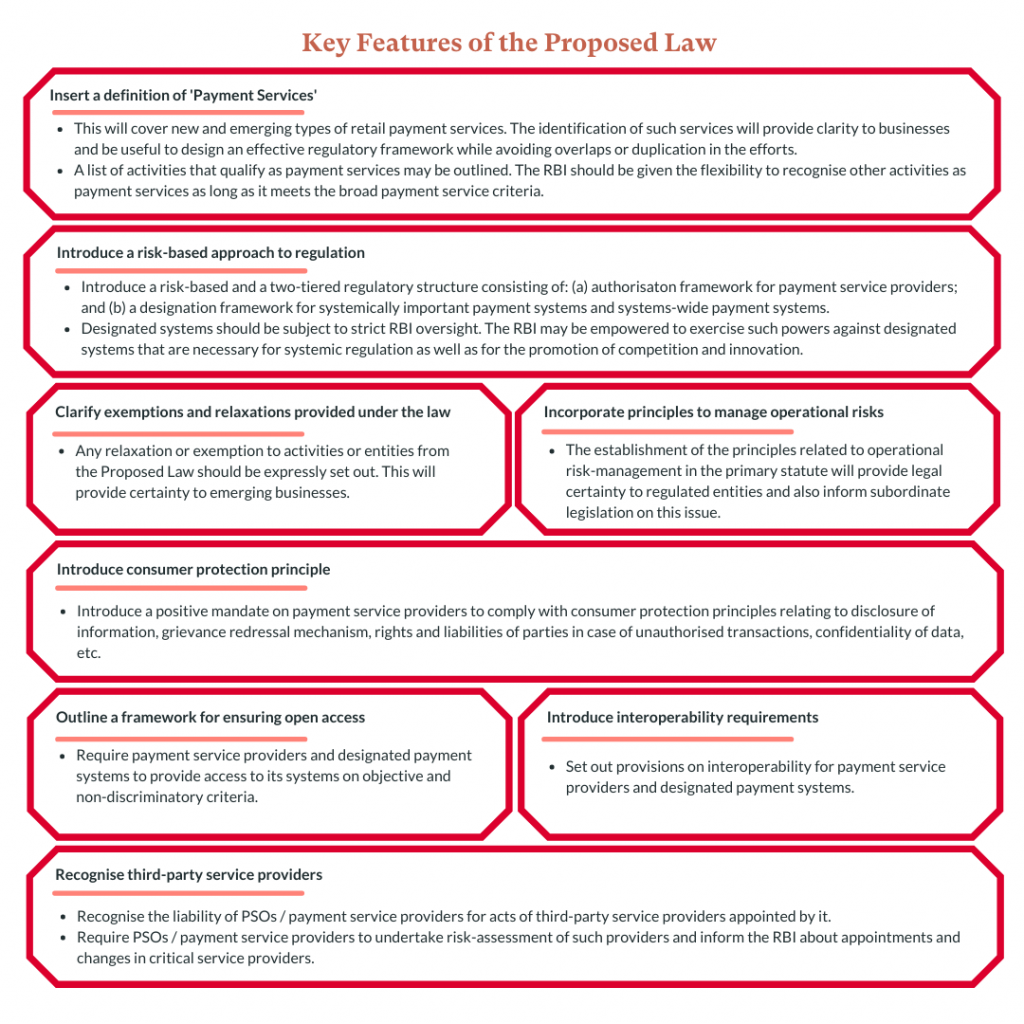

Modernising the Payment Services Law in India

The regulatory framework for digital payments under the PSS Act must be re-designed, to allow it to adapt to new payment products and services and to account for the evolving nature of the payments sector. The approaches and recommendations suggested in this Report for redesigning India’s payment services law is guided by three three primary policy objectives that underpin most modern payments law – (1) ensuring safety and soundness of payment systems, (2) promoting efficiency in the functioning of payment systems; and (3) the protection of consumer interests. To achieve an appropriate balance between these objectives, the Report relies on the following principles – (a) level of regulatory oversight should be commensurate to the risk posed by a payment activity; (b) provide legal certainty to businesses and consumers by setting out the broad contours and mandate under the principal law; and (c) provide flexibility to RBI to design subordinate regulations taking into account the evolving payments landscape. Possible approaches for designing the proposed law is set out below.