Deconstructing Digital-Only Banking Models | A Proposed Policy Roadmap for India

Deconstructing digital-only banking models, assessing their value propositions and suggesting a phased policy roadmap for India

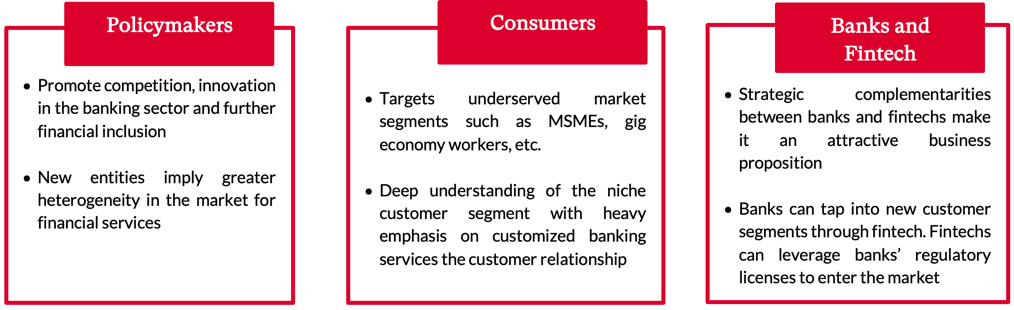

Technology has facilitated an influx of new business models in financial services, including exclusively digital branchless banking models, either in the form of licensed digital banks (witnessed in jurisdictions like UK, Hong Kong, Australia) or as partnerships between licensed banks and non-banks (witnessed in India). The ongoing COVID-19 pandemic has accentuated the role of contactless delivery of financial services. Going forward, as society adapts to the realities of a post-pandemic context, technology will play a significant role in the financial sector. This may be particularly relevant for underserved market segments such as micro, small, and medium enterprises (“MSMEs”) that has not been a priority for traditional banks. This research report deconstructs the digital-only banking models, assesses their value propositions and recommends a phased policy roadmap for India. Through this roadmap, the report seeks to leverage the bank-fintech partnerships in their current form and understand whether this may be scaled to licensed digital banks.

What is a digital-only banking model?

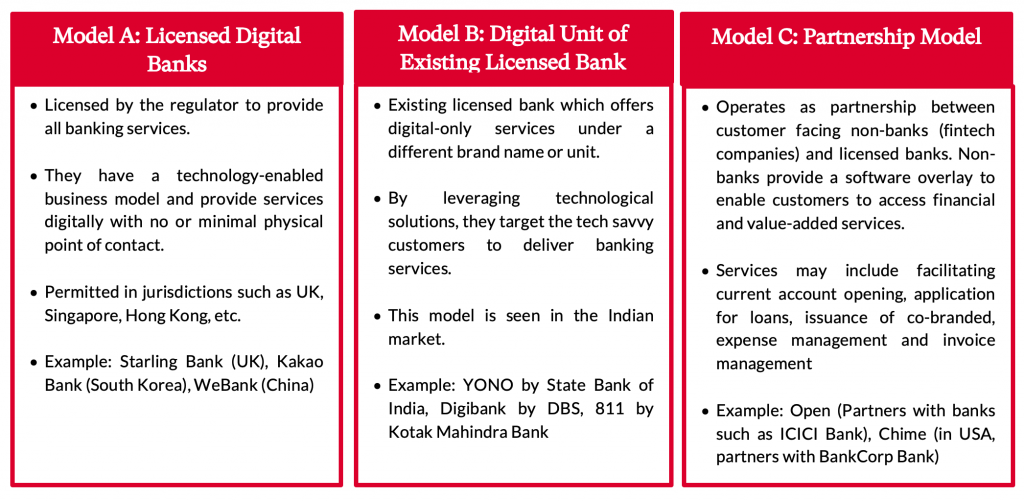

Digital-only banking models deliver banking services primarily through the digital medium instead of relying on physical branches. The term ‘digital bank’ is often interchangeably used with terms like ‘challenger bank’ or ‘neobank’ by market players. The specifics of the digital-only banking model is determined by the regulatory architecture in the country of operation. Broadly, this model manifests through three different forms.

How does the digital-only banking model work in India?

The existing regulatory architecture in India does not permit a fully licensed digital bank. Due to this, the digital-only banking model in India is structured as a partnership between a licensed bank and non-banks. These non-banks are typically fintech companies, which tend to identify themselves as ‘neobanks’ or ‘neobanking platforms’. They provide a technological interface which provides access to various banking and value added services. However, the bank provides the actual regulated service i.e. opening an account, accepting deposits, or issuing loans.

- Currently, there are around 17 neobanking platforms in India. While some of these platforms have launched their products, some are yet to formally begin operations. Out of these 17 platforms, 8 focus on serving the MSME segment, start-ups and businesses.

- Some prominent neobanking platforms in India are Niyo, Open, Jupiter, Hylobiz and RazorpayX.

- In 2019, neobanks in India had raised around $116 million, representing a seven-fold jump year-on-year, demonstrating a healthy appetite for market entrants in this segment (LiveMint, 2020).

Value proposition of digital-only banking modes

The case for regulatory intervention

This report argues that it is necessary for policymakers in India to design policy interventions for the neobanking sector. This is necessary to: (a) leverage the value proposition of the neobanking market in India that has been expanding at a steady pace and has attracted investor attraction; and (b) minimise the regulatory risks that may emanate from these models.

A review of the existing neobanking model in India indicates that there are certain practices that merit regulatory consideration:

1. Many platforms use terms like ‘bank’ or ‘banking’ to describe their services that risk the violation of the Banking Regulation Act, 1949 that only permits licensed banks to use these terms.

2. In some cases, platforms also fail to disclose their partner banks on the website.

3. To illustrate, usage of terms like ‘Banking of the Future’, ‘Banking made awesome’ etc. without any disclosure about partnership with a licensed bank may mislead consumers into thinking that these non-banks are authorised and regulated as licensed banks, when in fact their operations are carried out only through partnership with licensed banks.

4. Many platforms do not disclose the applicable consumer grievance redressal mechanism.

While such partnerships between a bank and fintech, typically structured as an outsourcing arrangement may be relevant for a nascent industry, going forward such models are likely to raise challenges for striking the balance between prudential risk management and promotion of innovation with the evolution of bank-fintech partnerships. This calls for a framework that can take into account the complexities of bank-fintech partnerships and facilitate the evolution of the such models into full licensing framework in the form of digital banks.

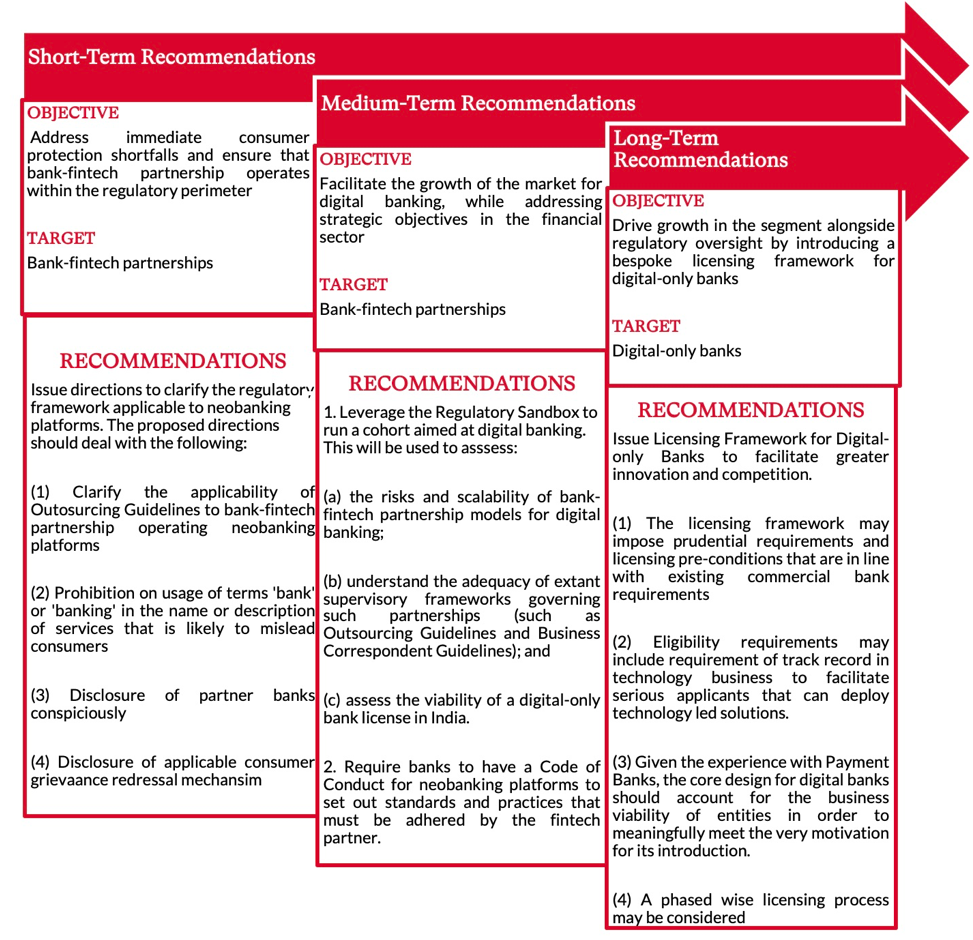

Proposed policy roadmap

Given that the neobanking sector in India is at a nascent stage, this report recommends a phased and proportionate regulatory response in terms of short term, medium term and long term recommendations. This will be relevant to address two objectives: (a) harness the potential of bank-fintech partnership in the banking sector under the Partnership Model; and (b) facilitate the entry of digital-only banks.