Unboxing the G20 buzzwords: Digital Public Infrastructures (‘DPIs’) and Digital Public Goods (‘DPGs’)

The keys to building an inclusive, efficient and resilient digital economy

As India is set to play leader and host to the world’s largest economies gathering for the G-20 deliberations, India’s digital success story serves as a shining example of what can be achieved through deployment of population-scale digital infrastructure. From improving access to healthcare, to empowering small businesses and increasing financial inclusion, India’s experiments with infrastructure such as United Payments Interface (‘UPI’), the Open Network for Digital Commerce (‘ONDC’) and CoWin are sure to serve as important reference points for building resilient and inclusive digital services delivery in other developing economies.

Forerunners in India’s expedition to inclusive digitalization are Digital Public Goods (‘DPGs’) and Digital Public Infrastructure (‘DPIs’) – buzzwords we aim to unpackage in this blogpost.

What are DPIs and DPGs?

- Digital Public Infrastructures

DPIs are core infrastructural facilities that aim to functionally mimic physical infrastructure. They are digital pathways that enable the provision of public services. DPIs may be visualised as ‘blocks of a stack’, with each block performing a specific function. These blocks layered one on top of the other allow creation of unique and novel solutions that drive innovation, inclusion and competition in a digital economy. The functionality of a DPI is solution-driven, value-generating and has broad applicability. These can include but are not limited to identity, payments and data exchanges.

- Digital Identity: A digital identity system allows for the verification and authentication of people and helps promote trust. Often, it forms the foundation for the digitisation of various government schemes and welfare programmes. Aadhaar is the foundational ID that has given identity to more than 1.35 billion Indians. Through Aadhaar, transparent direct benefit transfers of welfare subsidies to the bank accounts of the poor were facilitated. Aadhaar was a catalyst in driving financial inclusion in India and led to an increase in bank-account ownership from 35% in 2011 to 78% in 2021 according to the Global Findex Database 2021.

- Payments: A digital payment system allows for the flow and exchange of money through a real-time fast payment system. Launched in 2016, United Payment Interface (‘UPI’) is an interoperable electronic payment system built over the existing Immediate Payment System Service (‘IMPS’) infrastructure, that has allowed Indians to transfer money from one bank account to another bank account digitally and in real-time by creating a Virtual Payment Address (‘VPA’). It has rapidly gained a large share of India’s payment ecosystem, so much so that in FY 2022, UPI alone accounted for 52 percent of the total 8,840 crore financial digital transactions in India.

- Data Exchanges: A data exchange allows for an easy and secure sharing of information based on consent among a diverse network of users. They help in addressing the challenges associated with the unavailability of data, low quality of data, it being stored at multiple places and in low quality, lack of interoperability etc. Account Aggregators (‘AAs’) are data-blind consent managers that enable individuals to move their data between two financial institutions. The legal framework for AAs has been in place since 2016 through the RBI NBFC AA Directions that allowed a new kind of Non-Banking Financial Companies to act as data fiduciaries. Currently, more than 1.1 billion bank accounts are eligible to share data in the AA ecosystem through AAs.

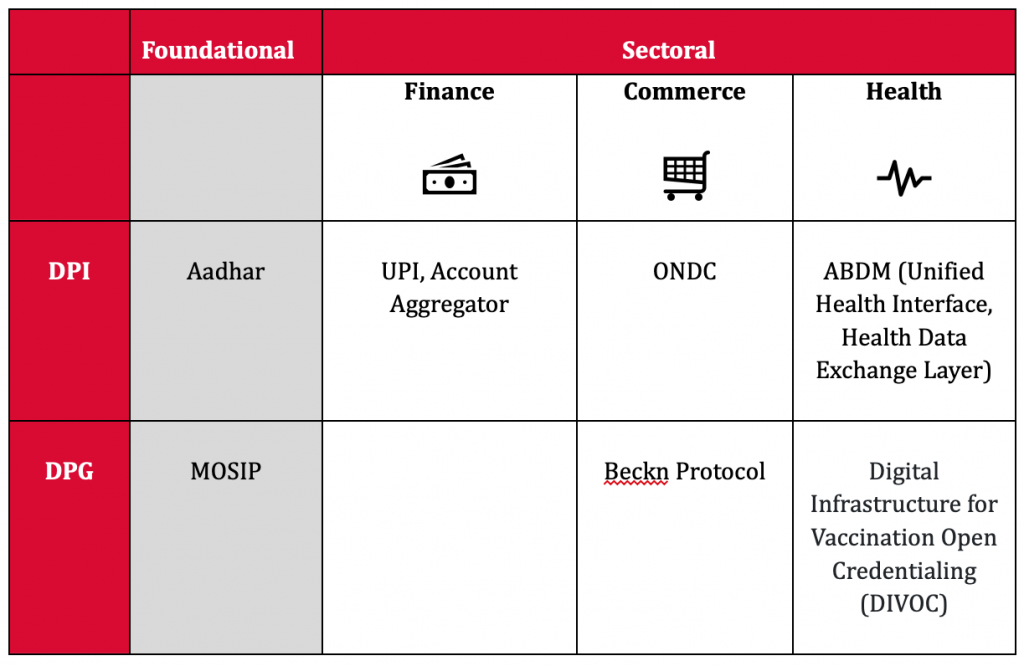

DPIs are built using proprietary technology or open-source solutions called DPGs. (explained below). The Indian DPI ecosystem, through India stack, is an intersection of foundational and sector-specific DPIs. The foundational DPIs have their usage also across different sectors illustrated in the figure below. For instance, Aadhaar as a foundational DPI is also used to plug into the UPI ecosystem which is a finance sector-specific DPI.

- Digital Public Goods

As defined by DPGA and endorsed by the UN Secretary General, they are “open-source software, open data, open AI models, open standards, and open content that adhere to privacy and other applicable laws and best practices, do no harm by design, and help attain the Sustainable Development Goals (SDGs).” These digital solutions are available to the government and other users to deploy, modify or reuse. Open source licensing allows for their code base to be independently scrutinised and audited, thus making them inherently accountable. It is the DPGA that operationalises the definition of DPG, through the DPG Standard. It defines the nine baseline requirements that a digital solution must meet to be recognised as a DPG, and thereafter become discoverable on the DPG Registry. Modular Open Source Identity Platform (‘MOSIP’) conceived as a DPG incubated in India helps Governments and other user organisations to implement a digital identity system in a cost-effective way by offering its modular core technology.

Some DPGs may form the core of developing a DPI, see for instance Beckn Protocol. Recognised as a DPG, Beckn Protocol is being used to build the Open Network for Digital Commerce (‘ONDC’). ONDC is the DPI for the commerce sector that aims to move exchange of goods and services from a platform-centric approach to a network-centric approach.

Why Do DPGs and DPIs matter?

DPIs and DPGs are key to building inclusive, efficient and resilient digital economies that support citizens and organisations. This is evident from the progress Estonia has made since 2001 in providing efficient state services. Its data exchange ecosystem, i.e. X Road which is an open source software enables public and private e-services information systems to seamlessly interact, saving Estonians approximately 1345 years of working time in just one year.

The pandemic further accentuated the importance of digitisation and the development of DPIs globally. It was essential to ensure that a cushion is provided against the ongoing economic and health crisis to the citizens. As a corollary, contactless payments received a boost from the government to facilitate emergency cash transfers. For instance, Togo’s Novissi Platform is one such DPI that was developed to facilitate emergency digital cash transfers from the Government of Togo to the most vulnerable without the need for intermediaries. The beneficiaries do not need internet access to register on the Novissi platform.

In addition to providing efficient state services and crisis management, DPIs have played a significant role in promoting financial as well as digital inclusion of citizens belonging to lower socio-economic backgrounds. A recent BIS working paper showed that financial inclusion in India, which would have taken nearly 50 years through traditional growth methods, was accomplished in only a decade due to India’s aggressive digitisation efforts via DPIs like Aadhaar. The journey that intends to fuel innovation, entrepreneurship and generate employment will be key to accelerating India’s economic growth trajectory. With India aiming at 1 billion smartphone users by 2026, a plethora of efficient DPIs are set to transform the way individuals and businesses conduct their transactions every day.